Don’t Guess Your Shipping Costs: A Strategic Guide for Used Car Exporters

In the fast-paced world of used car exports, success isn’t just about finding the right vehicles. It’s about mastering the logistics chain that gets them from Japan to your customers—on time, on budget, and without surprises. At FWT Logistics, we understand that freight costs are a critical factor in your profitability. This guide explains the key drivers behind shipping rate changes and shows how to use them to your advantage.

Spot Rates vs. Contract Rates: Choosing Your Financial Compass

The first big decision in your shipping strategy is how you buy freight.

Spot Rates

- Immediate, market-driven prices for single shipments.

- Change daily based on demand, capacity, and other market factors.

- Suitable for occasional or highly flexible shipments—but risky for regular exporters.

- Example: A sudden mid-year demand surge for cars into Mombasa can push spot rates up 25–30% within weeks, catching unprepared shippers off-guard.

Contract Rates

- Fixed-price agreements for a set period (often 6–12 months) tied to committed volumes.

- Offer stability, budget predictability, and often priority space.

- Ideal for regular exporters shipping consistent monthly volumes.

- Example: A Japanese exporter shipping 200 vehicles per month to Kenya secures a 12-month contract, insulating them from sudden mid-year Peak Season Surcharges (PSS) and reducing rollover risk.

Beyond the Price: What Drives Freight Rate Changes

Freight rates aren’t random—they reflect global supply chains in motion. We monitor these constantly so you don’t have to.

- Supply and Demand: When demand for space rises faster than capacity, rates climb.

- Example: In June 2025, Maersk introduced a PSS for Japan & Korea → Kenya/Tanzania, effective June 1, as volumes surged.

- Port Congestion: Delays and long berthing queues mean higher operating costs for carriers.

- Example: MSC announced a Mombasa Congestion Surcharge of USD 500 per container from January 13, 2025, citing heavy delays.

- Global Disruptions: Events like the Red Sea crisis in 2024–2025 forced rerouting around the Cape of Good Hope, adding 10–14 days to some services and raising costs by ~30%.

- Equipment Imbalances: Ports that import more than they export (e.g., Durban) often see higher inbound rates to cover the cost of repositioning empty containers.

Timing is Everything: How to Spot a Good Contract Window

Some exporters try to time contracts by the calendar. But the truth is: there’s no universal “best month”—only the right conditions.

On the Far East → East Africa corridor, recent seasons (2024–2025) saw carriers announce PSS in late May to June:

- Hapag-Lloyd’s Asia → Mombasa/Dar es Salaam PSS began June 1, 2024.

- Maersk’s Japan & Korea → Kenya/Tanzania PSS began June 1, 2025, with a broader Far East PSS effective June 12, 2025.

The smarter approach: Watch for these signals before fixing a contract:

- Spot rates have softened for 3–6 weeks.

- Carriers stop announcing new PSS/GRIs on your lane.

- Schedule reliability improves and booking rollovers drop.

Example: In 2025, spot rates cooled in late June/July after early-summer spikes—creating an opportunity for forwarders to negotiate favorable 12-month terms.

Real-World Case Study: Japan → Mombasa, Jan 2025

- Challenge: Spot shippers faced a “double hit”—Red Sea diversions inflated base rates, and MSC’s Mombasa Congestion Surcharge added USD 500/box.

- Result: Exporters without contracts saw cost jumps exceeding USD 1,500 per 40-foot container.

- Advantage: Contracted shippers avoided most surcharges, kept space allocations, and delivered vehicles on schedule.

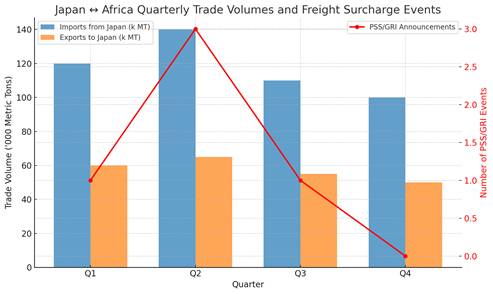

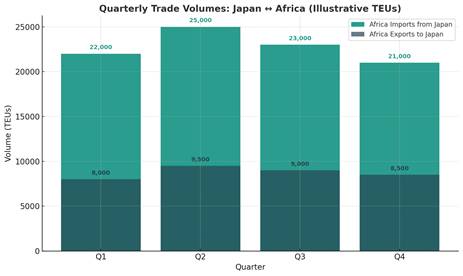

Quarterly Trade Flow: Japan ↔ Africa

Understanding volume trends helps anticipate pressure points. While patterns vary, aggregated Japan Ministry of Finance (MOF) and UN Comtrade data show:

- Q1 (Jan–Mar): Post-harvest buying in Africa boosts imports from Japan, often tightening space.

- Q2 (Apr–Jun): Stable to rising demand; in recent years, early-summer PSS announcements.

- Q3 (Jul–Sep): Variable demand—some easing in spot rates in recent years.

- Q4 (Oct–Dec): Contract windows often open here, but only if rates have softened and demand is moderate.

Data note: Quarterly figures compiled by FWT Logistics from Japan MOF monthly customs data and UN Comtrade (aggregated to quarters).

Your One-Window Partner for Used Car Logistics

Navigating these complexities alone is risky—and unnecessary. As a leading freight forwarder with deep expertise in Ro-Ro and containerized vehicle shipping, FWT Logistics provides:

- Competitive Ro-Ro & Container Rates: Leveraging carrier relationships for optimal terms to East Africa, South America, and beyond.

- Seamless “One-Window Operation”: From pre-export inspections and inland haulage in Japan to customs clearance at destination.

- Proactive Market Guidance: Bilingual specialists advising on timing, regulations, and negotiation strategies.

Don’t let freight volatility dictate your margins. Partner with FWT Logistics to ship smarter, protect your profits, and deliver with confidence.

📞 Contact us today for a competitive quote and a tailored shipping strategy.